After tumbling in the morning, US stocks pushed into the green to close out the day following the release of an economic report from the Commerce Department, which revealed that the US economy contracted in the first quarter.

The S&P 500 and Dow notched a seven-day winning streak, their best continuous rally this year. However, the indexes closed out April in the red as the stock market has been trying to recover from a steep slump caused by President Donald Trump’s tariffs.

The Gross Domestic Product (GDP) registered at an annualized rate of -0.3%, the department reported. This marks a sharp slowdown from the 2.4% growth rate in the fourth quarter and is well below economists’ expectations of a 0.8% increase.

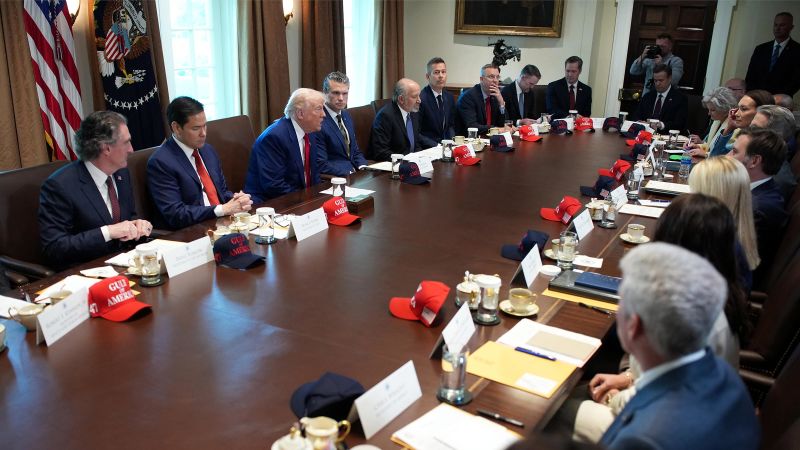

In response, Trump defended his administration’s economic record, blaming former President Joe Biden for the current challenges. “I’m not taking credit or discredit for the stock market, I’m just saying that we inherited a mess,” he said.

If you’re just joining us, here’s a recap of today’s key economic news:

Republicans and Democrats react: Republican senators voiced concern over the latest economic data but said they remain hopeful that Trump’s expansive legislative agenda — including tax cuts — will pass this summer, potentially steering the economy back on track. Republicans echoed Trump’s comments and blamed Biden for the current state of the economy. Meanwhile, Democratic Sen. Peter Welch said, “The person who is president of the United States bears the burden of what the economy is doing, or the benefit of what it’s doing.”

Trump adviser spins: Peter Navarro, special counselor to the president, attempted to spin the GDP report as “very positive news” for Americans, touting how tariffs are driving a “tremendous amount” of domestic investment. “This was the best negative print, as they say in the trade, for GDP I have ever seen in my life. It really should be very positive news for America,” Navarro said.

Inflation cooled: In other economic news, inflation slowed sharply in March, moving closer to the Federal Reserve’s 2% target, while consumer spending continued to fuel the economy. Read more.

Too soon to call recession: While the latest GDP report indicates a significant slowdown, it doesn’t necessarily signal that the US is in a recession — at least not yet. CNN’s Matt Egan explains why this contraction doesn’t automatically equate to a recession.

CNN’s Maureen Chowdhury, Donald Judd, Morgan Rimmer, Alison Main, Manu Raju, Casey Riddle, Kit Maher, Alicia Wallace, Bryan Mena and Matt Eagan contributed to this reporting.

This post was updated with details on the US stock market performance for today and the month of April.