A member of a religious order says the election of Pope Leo XIV may bring Americans back to church.

Will Pope Leo XIV have to file and pay U.S. taxes, despite his strict vow of poverty?

Leo is the first American pontiff in history. And U.S. citizens, no matter where they live or who they are, are required to pay tax on their worldwide income—if they owe any.

Even if they don’t owe tax, they may have to file a return with the Internal Revenue Service. And whether it’s the pope or the rest of us, there are good reasons to file despite not needing to. This year, the filing threshold is $17,000 of gross income for a single taxpayer who, like Leo, is age 65 or older.

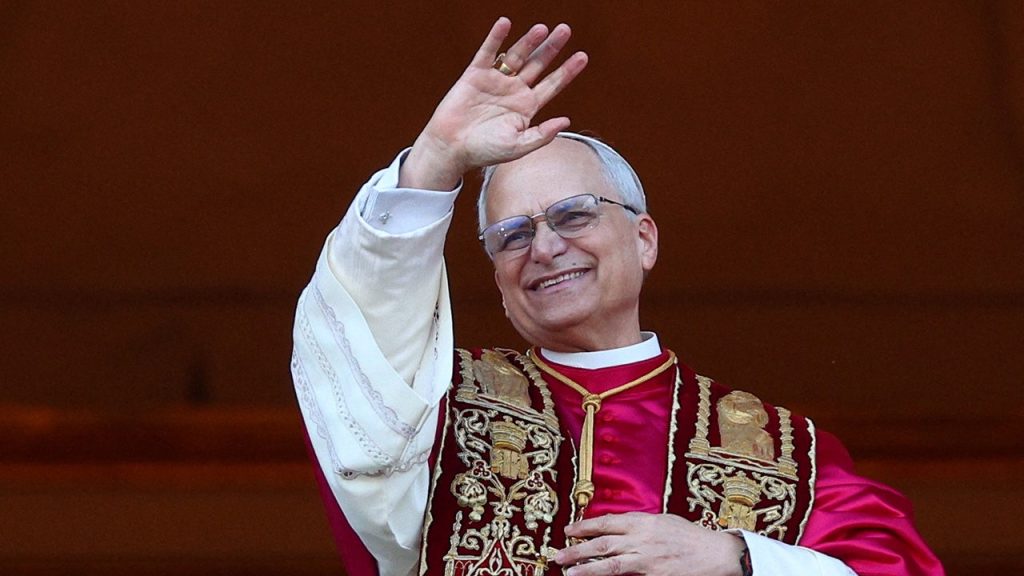

Newly elected Pope Leo XIV appears on the balcony of St. Peter’s Basilica, at the Vatican, on May 8, 2025. (REUTERS/Guglielmo Mangiapane / Reuters)

For the Chicago-born pope, however, there are unusual circumstances that could exempt him from owing or even filing U.S. taxes.

Here’s the background: In the Roman Catholic Church, rules about the ownership of property and income by Catholic clergy and members of religious orders vary widely. Not all take vows of poverty, and some poverty vows are stricter than others.

2025 TAX SEASON: WHAT DO RETURNS LOOK LIKE SO FAR THIS YEAR?

Members of the Order of St. Augustine, which Leo entered as Robert Prevost in his 20s, take the strictest vow of poverty, known as a Solemn Vow. On the night before they join the Order as full members, they sign a document renouncing their right to own property and saying they turn over all their goods to the Order.

Newly elected Pope Leo XIV, Cardinal Robert Prevost of the United States appears on the balcony of St. Peter’s Basilica, at the Vatican, May 8, 2025. REUTERS/Guglielmo Mangiapane (REUTERS/Guglielmo Mangiapane / Reuters)

The Wall Street Journal reviewed the pope’s renunciation, which he signed in 1981.

Fr. James Halstead, treasurer of the Midwest Augustinians that Leo joined, says that if a member earns a salary from teaching, it’s typically paid directly to the Order, which is a tax-exempt organization. This means that members don’t have taxable income.

If an Augustinian receives a gift or other income, he relinquishes that as well. Halstead adds that when the now-pope became a cardinal, he turned over a generous sum he received as a gift.

In addition, members don’t personally pay into Medicare and Social Security. Instead, the Order pays the levies from its income on behalf of them.

IRS SAYS TAX COLLECTION IS MORE EFFICIENT THIS YEAR, RECEIPTS UP MORE THAN 5%

As a result, Augustinians don’t file individual U.S. tax returns, and Halstead says the Order has no record of Leo’s filing any returns. The IRS allows this; for more information, see IRS Publication 517 for clergy.

Note: Not all vows of poverty lead to a tax exemption. The IRS has pursued and won cases involving vows of poverty that it questioned.

Other discussion about Leo’s U.S. taxes has focused on possible income—not the strict vow of poverty that could mean he has no income or responsibility to file.

Pope Leo XIV shakes hands during an audience with representatives of the media in Paul VI hall at the Vatican, May 12, 2025. (Reuters/Eloisa Lopez / Reuters)

Now that he’s pope, Leo and his advisers need to consider what to do going forward. The pope remains an Augustinian, and Halstead hopes he can continue his past practice. In that case, any payment or stipend for the pope could go directly to the Augustinians and he might not need to file.

Vatican officials didn’t respond to a request for comment about the pope’s pay or tax filing. A spokeswoman for the Treasury Department also declined to comment, citing taxpayer-privacy laws.

If Leo determines that he has income and needs to file a U.S. return, he could face issues that torment many Americans living abroad. The paperwork for expats is often onerous, and rules to prevent double taxation have gaps. During his 2024 campaign, President Trump advocated changing the rules, but the bill approved Wednesday by the House Ways and Means Committee doesn’t touch them.

If Pope Leo XIV determines that he has income and needs to file a U.S. return, he could face issues that torment many Americans living abroad. (Andrew Harrer/Bloomberg / Getty Images)

If he does file, Leo would likely benefit from the Foreign Earned Income Exclusion, a tax break that shelters earnings by Americans abroad. For 2025 the limit is $130,000 for a single filer—but to claim it, a taxpayer has to file.

ABOUT 20K IRS WORKERS ARE WEIGHING BUYOUT OFFERS

In addition, Vatican officials need to check whether Leo should file forms notifying U.S. authorities of certain foreign accounts or assets he has an interest in. The FBAR form often applies to expats with foreign financial accounts totaling more than $10,000 during the year, while IRS Form 8938 applies to various foreign financial assets of greater value.

One thing the pontiff probably doesn’t need to worry about is owing U.S. tax on the value of his accommodations, meals, travel, clothing and other expenses paid by the Vatican. Michael Graetz, a former Treasury official and emeritus professor at Yale Law School, says that in the pope’s case they don’t count as taxable income because they’re a condition of his employment.

Pope Leo XIV holds an audience with representatives of the media in Paul VI hall at the Vatican, May 12, 2025. (Reuters/Eloisa Lopez / Reuters)

Even if the pope isn’t required to file a U.S. tax return, some tax professionals recommend that he—and other Americans with little to no income—file anyway.

One reason is that filing a return can be a good way to prevent tax ID theft. This occurs when a fraudster uses someone else’s Social Security number and date of birth—like the pope’s—to fake a refund for themselves. Tax ID theft is cumbersome to unwind, and regularly filing returns makes it harder for fraudsters to act. Leo could also get a special IP PIN number that prevents anyone else from filing with his ID.

GET FOX BUSINESS ON THE GO BY CLICKING HERE

Matthew Plese, a CPA in Chicago who handles tax filings for many Catholic priests and members of religious orders, also advises his clients to file so the IRS will have a record of them. During the pandemic, it was harder for his clergy clients who hadn’t filed to get their stimulus payments, he says.

David Lifson, a CPA with Crowe who advises Americans with global income, says there’s a more important reason to file. Submitting a return to the IRS activates the statute of limitations, which doesn’t begin to run until then. For typical tax issues, the statute is three years.

He explains, “Filing a tax return is a way for Leo to show respect for his citizenship, and it actively affirms that he owes little to no tax.”