New York

CNN

—

President Donald Trump’s aggressive tariff plan was largely expected to impact the US economy’s first-quarter performance as companies loaded up on imported goods ahead of higher levies. But what few failed to anticipate was how much worse off the economy would have appeared without stockpiling.

“People are stockpiling now. That’s helping the economy now — and then they’re going to spend even less,” said Ryan Young, senior economist at the Competitive Enterprise Institute, a libertarian-leaning think tank.

GDP, or gross domestic product, which measures all the goods and services produced in the economy, fell to an annualized rate of -0.3% in the first quarter of this year, according to Commerce Department data released Wednesday. That remarkable drop from the prior 2.4% rate pushed stocks lower, ignited talk of a recession and underscored why Americans’ confidence in the economic outlook fell this week to the lowest level in 13 years.

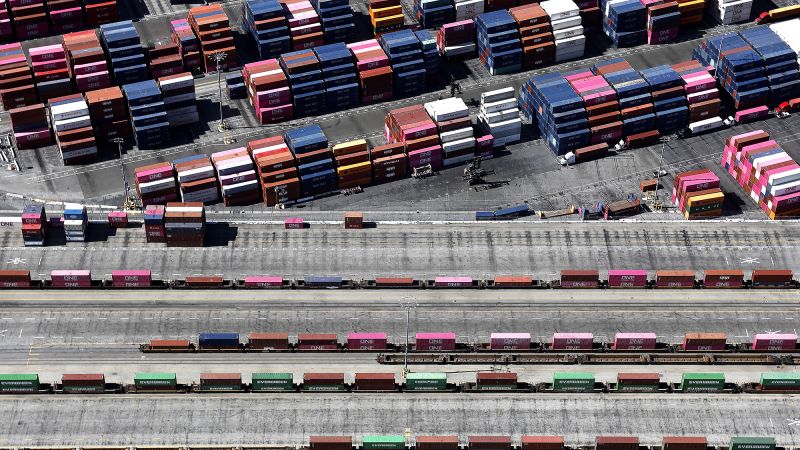

The core of last quarter’s decline was the rush to get ahead of Trump’s forthcoming tariffs. That pushed up goods imports by 51% in the first quarter, the fastest pace since 2020 when the US economy was reopening after Covid-related lockdowns.

But, absent that surge in goods, the latest GDP report could have been even uglier.

Trump made no secret of the fact that he was going to announce higher tariffs for all US trading partners as of April 2, a date he refers to as “Liberation Day.” But the question for businesses and consumers was: How high would those new tariffs be?

Waiting to find out could be costly. So businesses clamored to stockpile ahead of time and consumers moved up purchases, especially big-ticket items.

Because of the way GDP is calculated, increases in imports relative to exports put a drag on the economy. But at the same time, the uptick in imports fed right into a huge increase in business investments. All else being equal, higher investment levels boost GDP. In this case, it wasn’t enough to overcome the negative impact of imports, however.

The 22% increase in business investment was enough for White House senior trade adviser Peter Navarro on Wednesday to call the GDP report “the best negative print I have ever seen in my life.” However, he failed to mention that much of the increase in investment came from businesses buying up inventory.

The other factor that prevented GDP from declining further was the 1.8% increase in consumer spending last quarter. But once again, that traces back to pre-tariff moves.

“Stockpiling is making things look better than they actually are,” said Young. “And the flip side of that is that it’s going to slow down once that midnight rush is over.”

“The second-quarter GDP numbers could be brutal,” he added.

Gregory Daco, chief economist at Ernst & Young, said the data was largely emblematic of “an artificial pull-forward in demand — and what often lies beyond these pull-forward effects is a cliff.”

“We may actually see that in the second quarter, consumer spending, activity, business investment and inventories are all major drags on growth,” Daco told CNN.

Some economists read Wednesday’s GDP report with a slightly more sanguine tone.

“This report is almost exactly what an otherwise-healthy economy looks like *anticipating* — but not yet directly hurt by — tariffs,” Ernie Tedeschi, director of economics at the Budget Lab at Yale University and a former top economist in the Biden White House, said in a post on X.

Brian Rose, senior US economist at UBS, went further, saying he saw the GDP reading as a sign “that the underlying business cycle remains healthy.”

“We are not overly concerned about the negative GDP print,” he said in a note on Wednesday, pointing to the fact that the US economy contracted in the first quarter of 2022 and quickly pivoted back to growth.

However, this year’s second-quarter GDP report is unlikely to improve as the effects of Trump’s levies — the highest in the developed world — become more pronounced, he said.